Tata Teleservices Maharashtra Limited (TTML) has been a significant player in India’s telecommunications sector.

Understanding potential share price targets becomes crucial as investors look toward the future.

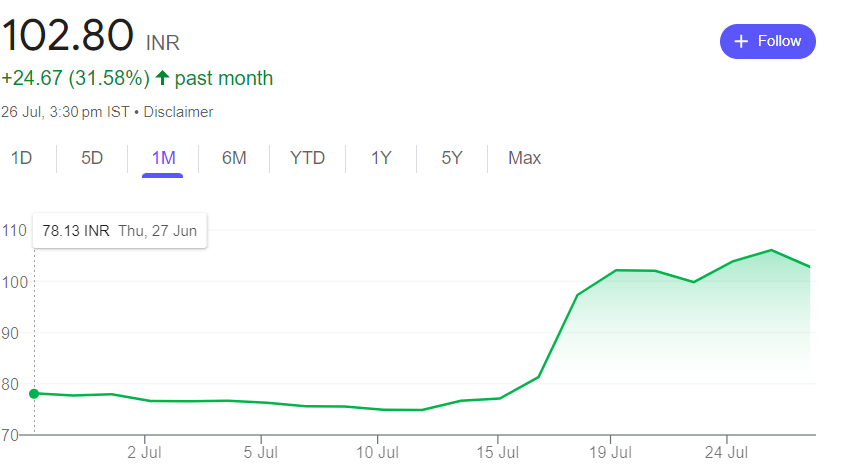

Based on current market trends and historical data, this article provides a comprehensive analysis of TTML’s projected share prices from 2024 to 2035.

TTML Share Price Target 2024

In 2024, TTML’s share price is expected to show moderate growth, influenced by ongoing developments in the telecom sector.

| Month | Lower Target | Higher Target |

|---|---|---|

| July | ₹109.55 | ₹114.93 |

| August | ₹111.24 | ₹116.00 |

| September | ₹114.72 | ₹121.79 |

| October | ₹120.22 | ₹127.26 |

| November | ₹127.36 | ₹132.19 |

| December | ₹123.91 | ₹129.00 |

By the end of 2024, TTML shares could reach a maximum of ₹129.00, showing a steady upward trend throughout the latter half of the year.

TTML Share Price Target 2025

The year 2025 might see TTML capitalizing on technological advancements, potentially leading to an increase in share value.

| Month | Lower Target | Higher Target |

|---|---|---|

| January | ₹120.68 | ₹127.92 |

| February | ₹130.57 | ₹136.08 |

| March | ₹128.58 | ₹132.82 |

| April | ₹128.35 | ₹134.54 |

| May | ₹133.79 | ₹138.93 |

| June | ₹135.49 | ₹139.80 |

| July | ₹136.75 | ₹142.09 |

| August | ₹138.55 | ₹144.27 |

| September | ₹141.10 | ₹145.73 |

| October | ₹145.27 | ₹150.80 |

| November | ₹152.55 | ₹156.84 |

| December | ₹150.57 | ₹156.22 |

If market conditions remain favorable, TTML’s share price could reach up to ₹156.22 by the end of 2025, representing significant growth from 2024.

TTML Share Price Target 2026

By 2026, TTML’s investments in network infrastructure may start yielding results, potentially reflecting positively on its share price.

| Month | Lower Target | Higher Target |

|---|---|---|

| January | ₹147.32 | ₹154.08 |

| February | ₹156.80 | ₹161.51 |

| March | ₹155.23 | ₹158.65 |

| April | ₹154.65 | ₹161.46 |

| May | ₹161.06 | ₹166.98 |

| June | ₹160.87 | ₹167.49 |

| July | ₹163.63 | ₹171.18 |

| August | ₹163.84 | ₹170.98 |

| September | ₹166.57 | ₹171.69 |

| October | ₹172.34 | ₹178.23 |

| November | ₹180.10 | ₹186.02 |

| December | ₹178.27 | ₹184.50 |

The projections suggest that TTML’s share price could reach ₹184.50 by the end of 2026, indicating steady growth over the years.

TTML Share Price Target 2030

Looking further ahead to 2030, TTML may have expanded its services and market reach, potentially leading to significant share price growth.

| Quarter | Lower Target | Higher Target |

|---|---|---|

| Q1 2030 | ₹273.69 | ₹284.73 |

| Q2 2030 | ₹280.40 | ₹291.73 |

| Q3 2030 | ₹287.11 | ₹298.73 |

| Q4 2030 | ₹286.38 | ₹298.16 |

By the end of 2030, optimistic projections suggest TTML’s share price could reach up to ₹298.16, representing substantial growth over the decade.

TTML Share Price Target 2035

Projecting share prices for 2035 involves considerable uncertainty. However, if TTML continues to adapt to technological changes and market demands, it could see substantial growth.

| Quarter | Lower Target | Higher Target |

|---|---|---|

| Q1 2035 | ₹399.52 | ₹416.28 |

| Q2 2035 | ₹406.22 | ₹423.28 |

| Q3 2035 | ₹412.93 | ₹430.28 |

| Q4 2035 | ₹387.93 | ₹405.28 |

The long-term projection suggests that TTML’s share price could potentially reach ₹405.28 by the end of 2035, indicating significant growth over two decades.

Factors Influencing TTML’s Share Price

Several factors could influence TTML’s share price performance:

- Technological Advancements: The successful implementation of new technologies could boost TTML’s market position.

- Market Competition: The ability to compete with other telecom providers will be crucial for TTML’s growth.

- Infrastructure Development: Continued investment in network infrastructure could enhance service quality and customer base.

- Regulatory Environment: Changes in telecom regulations can significantly impact TTML’s operations and share price.

- Global Economic Conditions: Broader economic factors can influence investor sentiment and market performance.

Long-Term Outlook

Looking at the long-term projections, we can see a steady upward trend in TTML’s share price:

| Year | Lower Target | Higher Target |

|---|---|---|

| 2024 | ₹123.91 | ₹129.00 |

| 2025 | ₹150.57 | ₹156.22 |

| 2026 | ₹178.27 | ₹184.50 |

| 2027 | ₹203.45 | ₹212.04 |

| 2028 | ₹231.56 | ₹240.92 |

| 2030 | ₹286.38 | ₹298.16 |

| 2035 | ₹387.93 | ₹405.28 |

This long-term view suggests potential for significant growth, with the share price potentially more than tripling from 2024 to 2035.

Conclusion

While these projections provide a glimpse into TTML’s potential future performance, it’s crucial to remember that the stock market is inherently unpredictable. Many factors can influence share prices, including company performance, economic conditions, and industry trends.

Investors should conduct thorough research and consider seeking advice from financial experts before making investment decisions. Remember, past performance doesn’t guarantee future results. Stay informed about TTML’s financial reports, TTML share news, and broader economic factors to make well-informed investment choices.

FAQs

What is the estimated share price target for TTML in 2024?

TTML’s share price is projected to reach a maximum of ₹129.00 by the end of 2024.

What is the long-term share price projection for TTML in 2035?

By 2035, optimistic projections suggest TTML’s share price could potentially reach ₹405.28.

How might technological advancements impact TTML’s share price?

The successful implementation of new technologies could positively influence TTML’s market position and potentially boost its share price.

What factors should investors consider when evaluating TTML’s future performance?

Investors should consider technological advancements, market competition, infrastructure development, regulatory environment, and global economic conditions.

How consistent is TTML’s projected growth over the years?

The projections show a steady upward trend from 2024 to 2035, with the share price potentially more than tripling over this period. However, it’s important to note that actual performance may vary.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. The stock projections mentioned are speculative and should not be considered as guaranteed outcomes. Investing in stocks carries inherent risks, and past performance is not indicative of future results. Readers are advised to conduct their research and consult with a qualified financial advisor before making any investment decisions.